The Only Guide for Pacific Prime

The Only Guide for Pacific Prime

Blog Article

Unknown Facts About Pacific Prime

Table of ContentsTop Guidelines Of Pacific PrimeSome Ideas on Pacific Prime You Need To KnowSome Known Incorrect Statements About Pacific Prime The 9-Second Trick For Pacific PrimeTop Guidelines Of Pacific Prime

Your representative is an insurance policy specialist with the understanding to direct you with the insurance coverage process and help you discover the best insurance coverage protection for you and the people and points you care concerning most. This short article is for informative and recommendation purposes only. If the plan coverage descriptions in this article problem with the language in the plan, the language in the policy applies.

Policyholder's deaths can additionally be contingencies, specifically when they are taken into consideration to be a wrongful death, as well as property damage and/or destruction. Due to the uncertainty of stated losses, they are classified as backups. The insured person or life pays a premium in order to receive the advantages guaranteed by the insurance company.

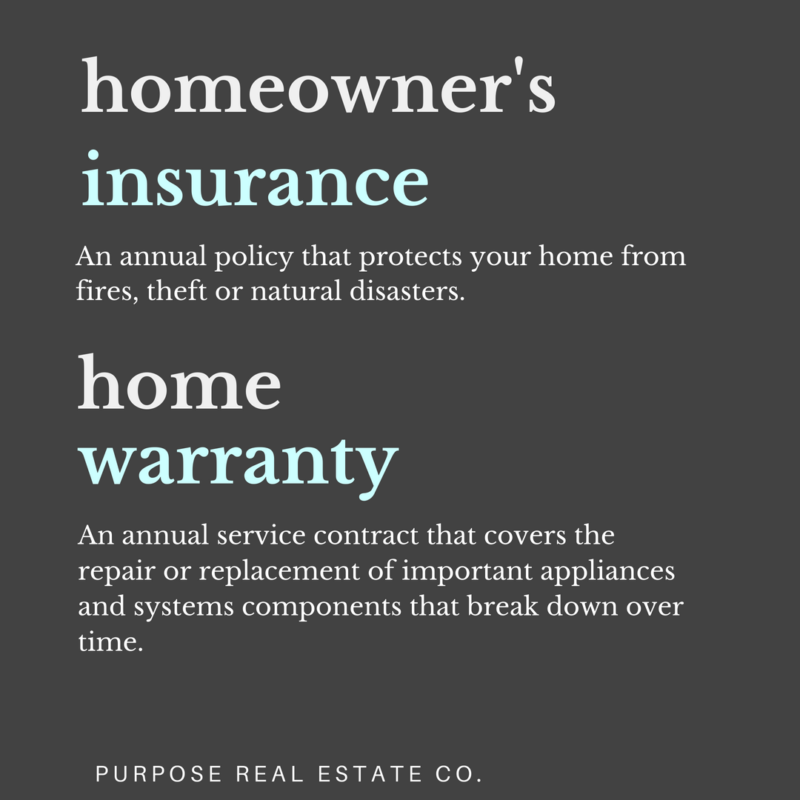

Your home insurance policy can help you cover the problems to your home and afford the price of restoring or fixings. Occasionally, you can also have coverage for items or prized possessions in your house, which you can then buy replacements for with the cash the insurer gives you. In the event of an unfavorable or wrongful fatality of a sole income earner, a family members's economic loss can possibly be covered by certain insurance policy strategies.

The 45-Second Trick For Pacific Prime

There are numerous insurance policy plans that consist of savings and/or investment plans in enhancement to regular coverage. These can assist with building savings and riches for future generations using normal or repeating financial investments. Insurance coverage can assist your family keep their standard of living on the occasion that you are not there in the future.

One of the most fundamental kind for this kind of insurance, life insurance policy, is term insurance coverage. Life insurance policy in general aids your family members become secure financially with a payout amount that is given up the occasion of your, or the plan owner's, death during a particular plan duration. Youngster Plans This sort of insurance coverage is basically a cost savings tool that aids with generating funds when youngsters get to certain ages for seeking greater education and learning.

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

Home Insurance coverage This sort of insurance coverage covers home damages in the cases of accidents, natural calamities, and accidents, in addition to other similar events. expat insurance. If you are aiming to seek compensation for mishaps that have occurred and you are having a hard time to determine the proper course for you, get to out to us at Duffy & Duffy Law Practice

The smart Trick of Pacific Prime That Nobody is Discussing

At our law practice, we understand that you are going through a great deal, and we comprehend that if you are coming to us that you have been through a whole lot. https://www.easel.ly/browserEasel/14457146. Due to that, we offer you a totally free appointment to review your problems and see exactly how we can best help you

As a result of the COVID pandemic, court systems have been closed, which adversely affects automobile mishap cases in an incredible way. We have a great deal of skilled Long Island auto crash attorneys that are enthusiastic regarding defending you! Please contact us if you have any kind of questions or concerns. global health insurance. Again, we are right here to aid you! If you have an injury claim, we wish to ensure that you get the payment you deserve! That is what we are right here for! about his We happily offer the people of Suffolk County and Nassau Region.

An insurance coverage policy is a legal agreement between the insurance provider (the insurance provider) and the person(s), service, or entity being insured (the insured). Reading your policy aids you confirm that the policy fulfills your needs which you understand your and the insurer's duties if a loss occurs. Lots of insureds purchase a plan without understanding what is covered, the exemptions that take away protection, and the problems that should be satisfied in order for coverage to use when a loss takes place.

It recognizes that is the insured, what threats or residential or commercial property are covered, the policy limitations, and the policy period (i.e. time the policy is in pressure). The Affirmations Web page of a life insurance plan will certainly consist of the name of the individual insured and the face amount of the life insurance coverage plan (e.g.

This is a summary of the significant pledges of the insurance policy company and states what is covered.

Our Pacific Prime Ideas

Allrisk protection, under which all losses are covered except those losses especially omitted. If the loss is not left out, then it is covered. Life insurance policies are commonly all-risk policies. Exemptions take coverage away from the Insuring Agreement. The 3 major kinds of Exemptions are: Left out hazards or reasons for lossExcluded lossesExcluded propertyTypical examples of left out perils under a house owners plan are.

Report this page